The Benefits Of Insurance Coverage For Contractors

As a contractor, you pour your heart and soul into every project that comes your way. Whether you’re building a new home, renovating a commercial space, or specializing in a particular trade, your work is the backbone of the construction industry. However, with great reward comes great risk. Accidents can happen, and without proper protection, your business could be left vulnerable to financial ruin.

This is where insurance coverage comes in – a vital safety net that can help protect you, your business, and your clients from the unexpected. In this article, we’ll explore the benefits of insurance coverage for contractors and why it’s essential to have the right policies in place.

What is Insurance Coverage for Contractors?

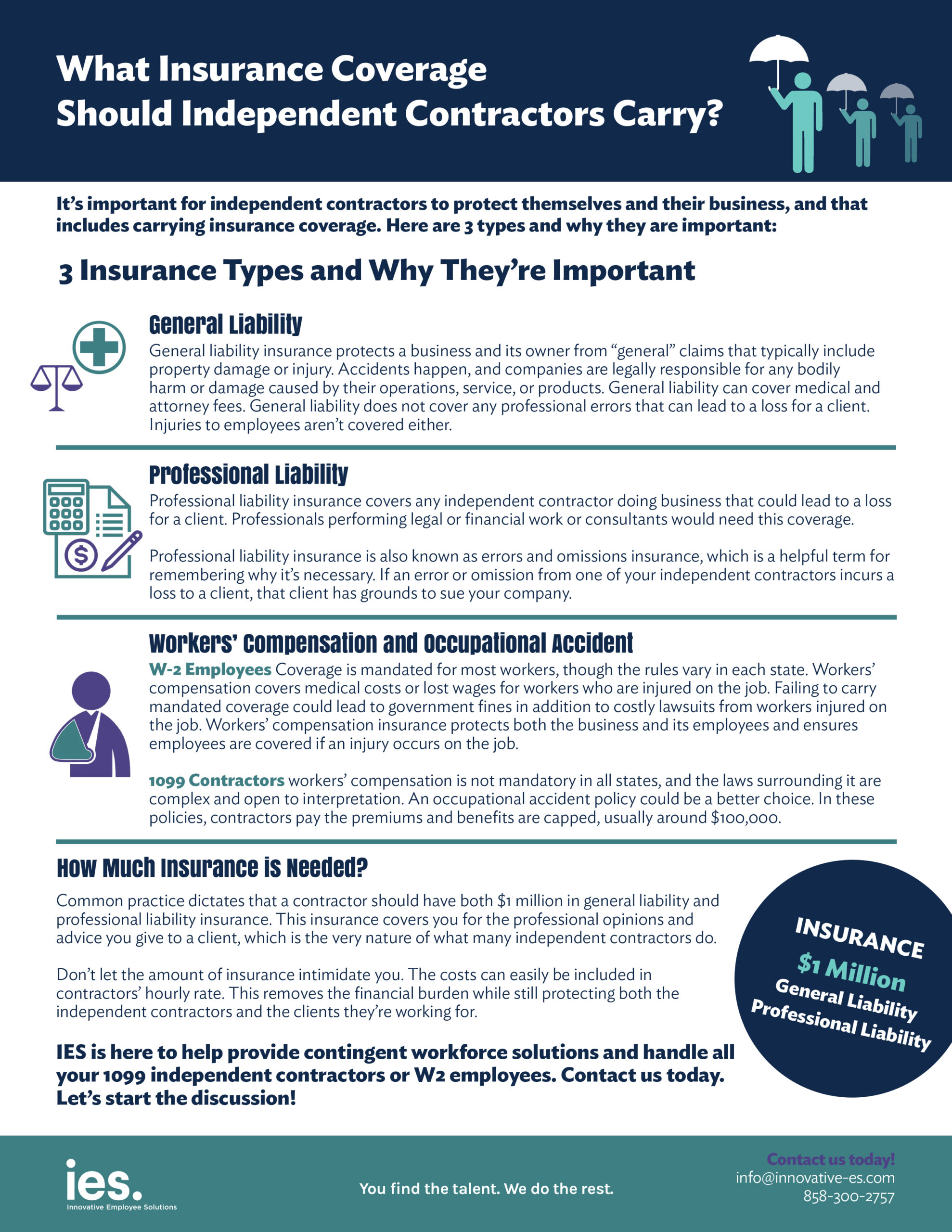

Insurance coverage for contractors is a type of insurance that provides financial protection to contractors, builders, and construction professionals in case of accidents, property damage, or other unforeseen events. This can include policies such as:

- General Liability Insurance: protects against claims of bodily injury, property damage, and personal injury.

- Workers’ Compensation Insurance: provides coverage for employee injuries and illnesses on the job.

- Professional Liability Insurance: protects against claims of negligence or professional misconduct.

- Equipment Insurance: covers damage to or loss of equipment, tools, and machinery.

- Commercial Vehicle Insurance: provides coverage for company vehicles and drivers.

The Benefits of Insurance Coverage for Contractors

Having the right insurance coverage in place can provide a range of benefits for contractors, including:

- Financial Protection: insurance coverage can help protect your business from financial ruin in case of an accident or unexpected event.

- Risk Management: insurance coverage can help you manage and mitigate risk, reducing the likelihood of financial losses.

- Compliance: having the right insurance coverage can help you comply with regulatory requirements and industry standards.

- Peace of Mind: knowing that you have insurance coverage can give you peace of mind, allowing you to focus on your work without worrying about the unexpected.

- Improved Credibility: having insurance coverage can improve your credibility with clients and partners, demonstrating that you’re a responsible and professional contractor.

- Increased Competitive Advantage: having the right insurance coverage can set you apart from competitors, demonstrating that you’re committed to quality and safety.

- Protection for Your Employees: workers’ compensation insurance can provide financial protection for your employees in case of injury or illness on the job.

- Protection for Your Equipment: equipment insurance can provide financial protection for your equipment, tools, and machinery in case of damage or loss.

Types of Insurance Coverage for Contractors

As a contractor, you’ll need to consider a range of insurance options to ensure that you have the right coverage in place. Here are some of the most common types of insurance coverage for contractors:

- General Liability Insurance: this type of insurance provides coverage for bodily injury, property damage, and personal injury. It’s a must-have for all contractors, as it can help protect you against claims of negligence or professional misconduct.

- Workers’ Compensation Insurance: if you have employees, you’ll need to have workers’ compensation insurance to provide financial protection for them in case of injury or illness on the job.

- Professional Liability Insurance: if you provide professional services, such as architectural or engineering services, you’ll need professional liability insurance to protect against claims of negligence or professional misconduct.

- Equipment Insurance: if you rely on equipment, tools, and machinery to do your job, you’ll need equipment insurance to provide financial protection in case of damage or loss.

- Commercial Vehicle Insurance: if you use company vehicles to transport employees, equipment, or materials, you’ll need commercial vehicle insurance to provide coverage for accidents or damage.

How to Choose the Right Insurance Coverage for Your Business

Choosing the right insurance coverage for your business can be complex, but here are some tips to help you make the right decision:

- Assess Your Risks: take a close look at your business and assess your risks. What are the biggest threats to your business? What could happen if you don’t have insurance coverage?

- Research Insurance Providers: research different insurance providers to compare rates and coverage options.

- Read Reviews: read reviews from other contractors who have used insurance coverage to get a sense of what works and what doesn’t.

- Consider Your Budget: consider your budget and what you can afford to pay for insurance coverage.

- Get Quotes: get quotes from different insurance providers to compare options.

- Ask Questions: ask questions about coverage options, exclusions, and deductibles.

Common Mistakes Contractors Make When Choosing Insurance Coverage

Here are some common mistakes contractors make when choosing insurance coverage:

- Underinsuring: underinsuring can leave you vulnerable to financial ruin in case of an unexpected event.

- Overinsuring: overinsuring can be expensive and unnecessary.

- Failing to Read Policy Details: failing to read policy details can leave you with unexpected surprises down the road.

- Not Shopping Around: not shopping around can leave you with a more expensive policy than you need.

- Not Considering Exclusions and Deductibles: not considering exclusions and deductibles can leave you with unexpected costs in case of a claim.

Conclusion

Insurance coverage for contractors is a vital safety net that can help protect you, your business, and your clients from the unexpected. By understanding the benefits of insurance coverage, you can make informed decisions about your business and ensure that you have the right protection in place. Remember to assess your risks, research insurance providers, and get quotes to compare options. By taking the time to choose the right insurance coverage, you can have peace of mind, knowing that you’re protected against the unexpected.

Additional Tips and Recommendations

Here are some additional tips and recommendations for contractors:

- Consider a Business Owner’s Policy (BOP): a BOP provides a package of insurance coverage for contractors, including liability, property, and business interruption insurance.

- Consider an Umbrella Policy: an umbrella policy provides additional liability coverage beyond what’s covered in your standard liability policy.

- Review Your Policy Regularly: review your policy regularly to ensure that it’s still meeting your needs.

- Ask About Discounts: ask about discounts for bundling policies or for having a good claims history.

- Consider Hiring an Insurance Broker: consider hiring an insurance broker to help you navigate the complex insurance landscape.

By following these tips and recommendations, you can ensure that you have the right insurance coverage in place to protect your business and future.